Accounting

/Configuration

Configuration

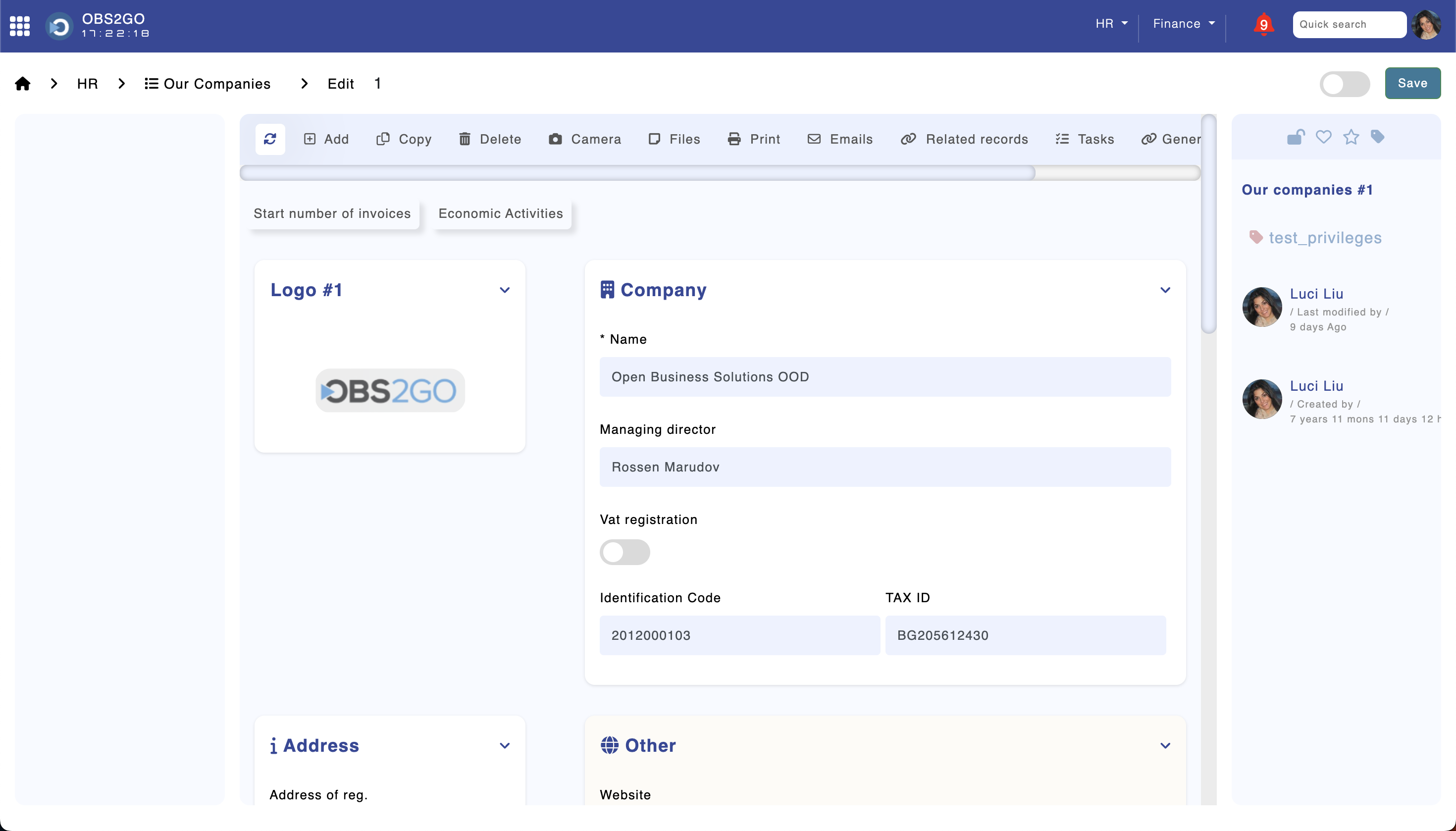

Company data

Input the company data in module "Our companies". You can register unlimited number of companies.

Module "Our companies"

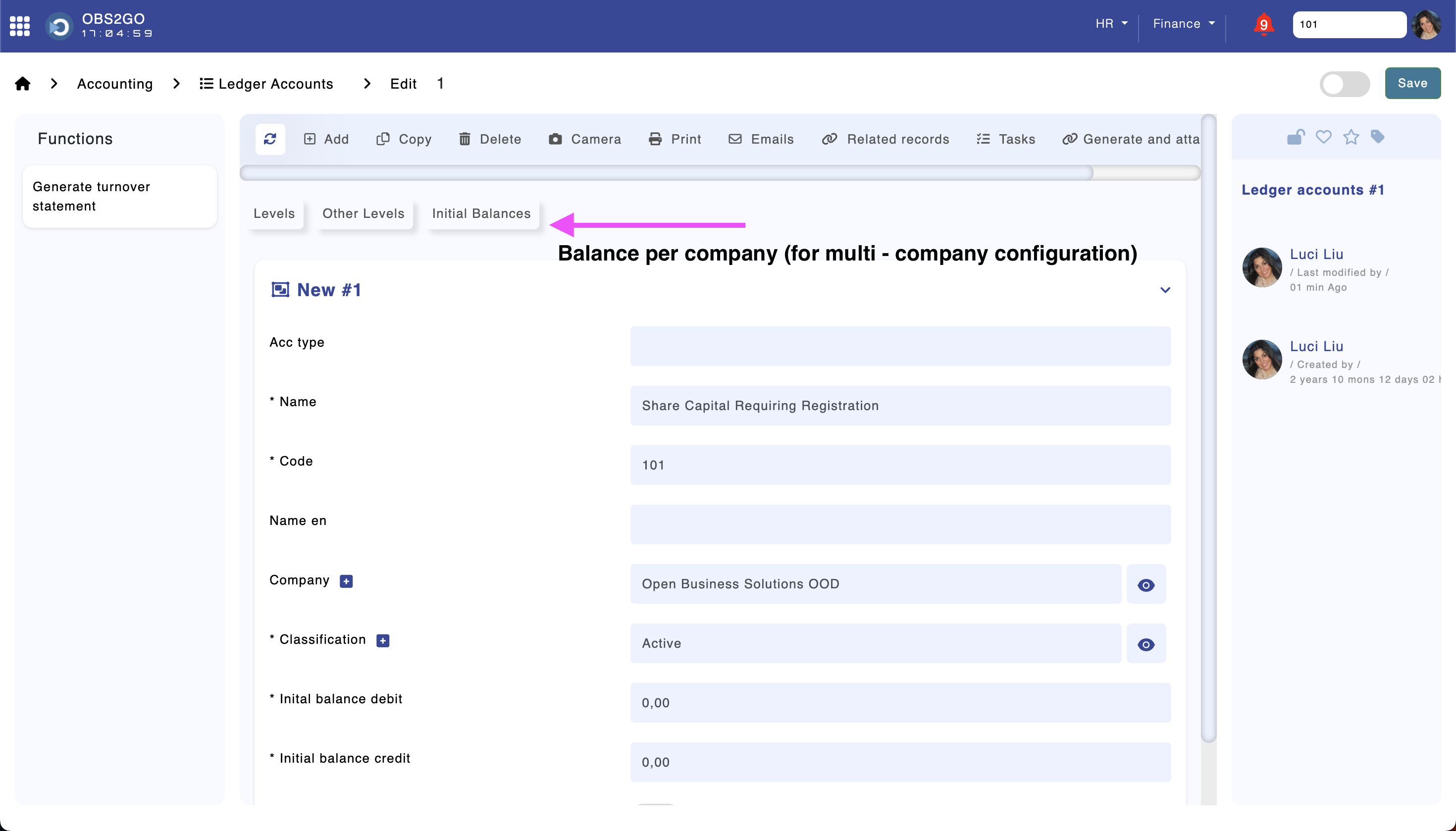

Ledger accounts

The "Chart of Accounts" module allows for a complete description of the general ledger accounts for each of the companies that are registered in the "Our Companies" module. By default, the module is empty.

This is the module where you can fully describe the accounts that will be used for accounting purposes. The initial balances can be set for each account.

Module "Ledger accounts"

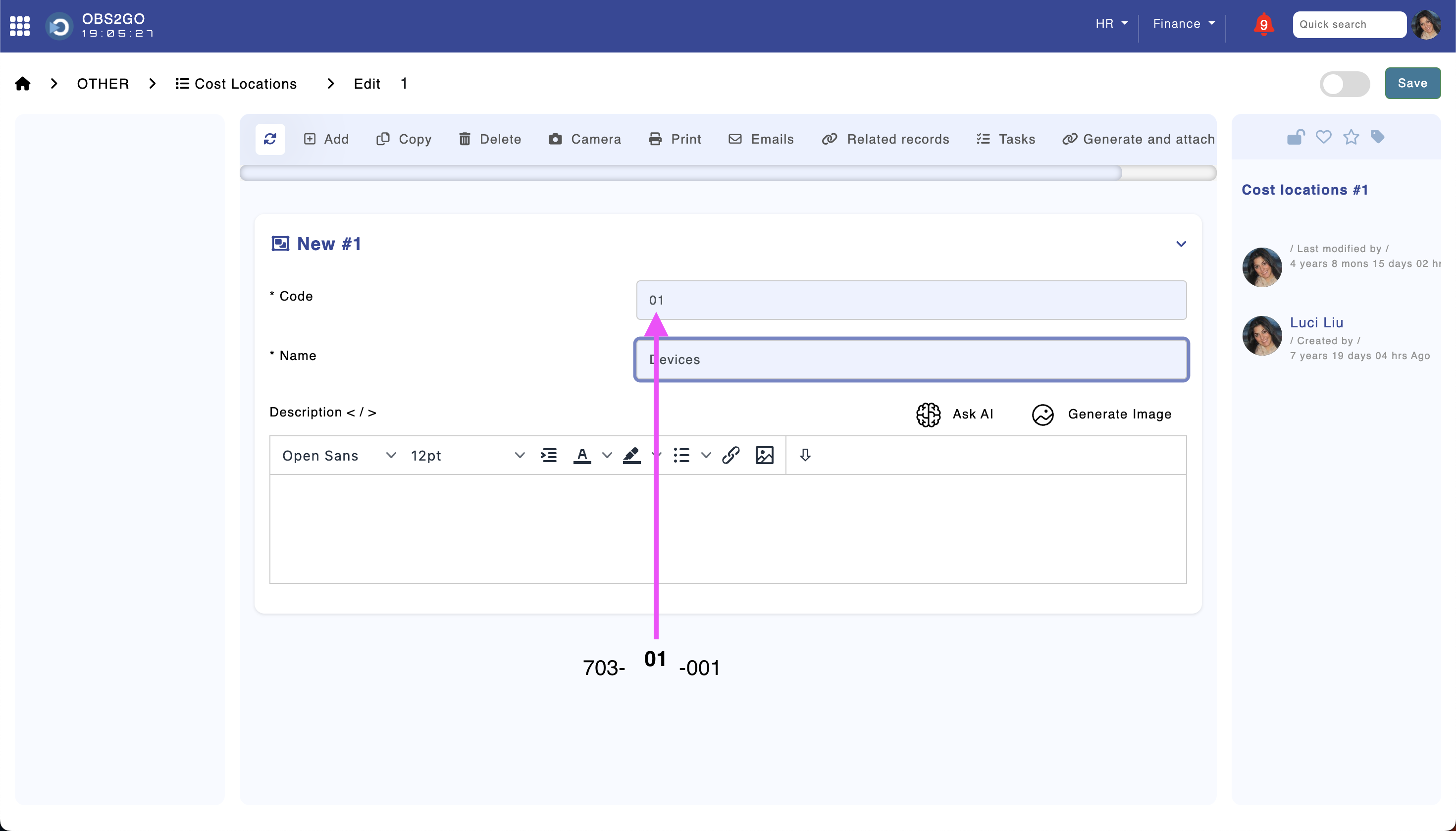

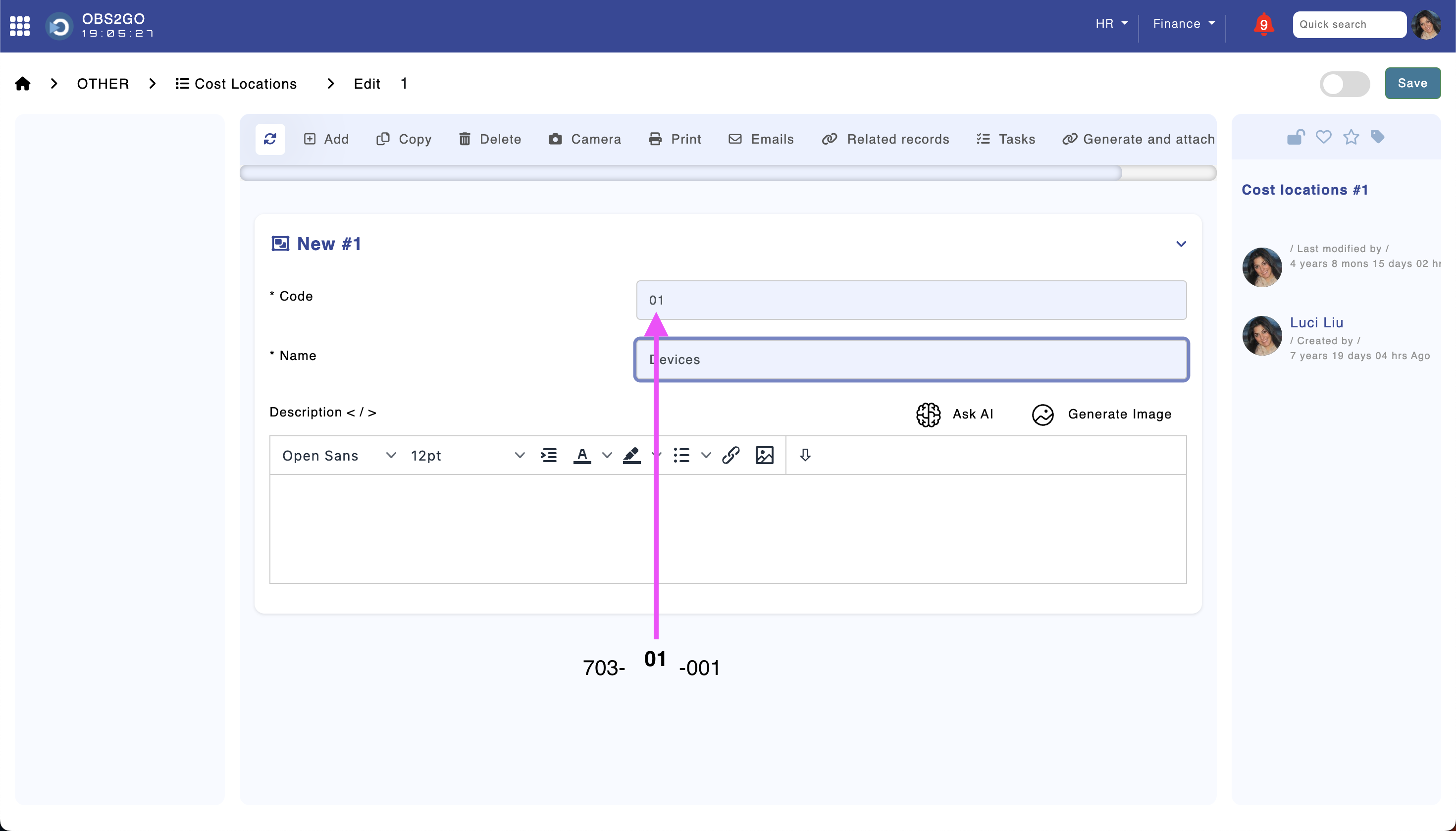

Account code structure:

- 703-01-001 - Income mobile devices

- 703-02-001 - Income consultancy

Where 701 - account code; 01 - profit/cost center; 001 - analytical level; Example: 701 income; 01 - devices; 001 - mobile devices

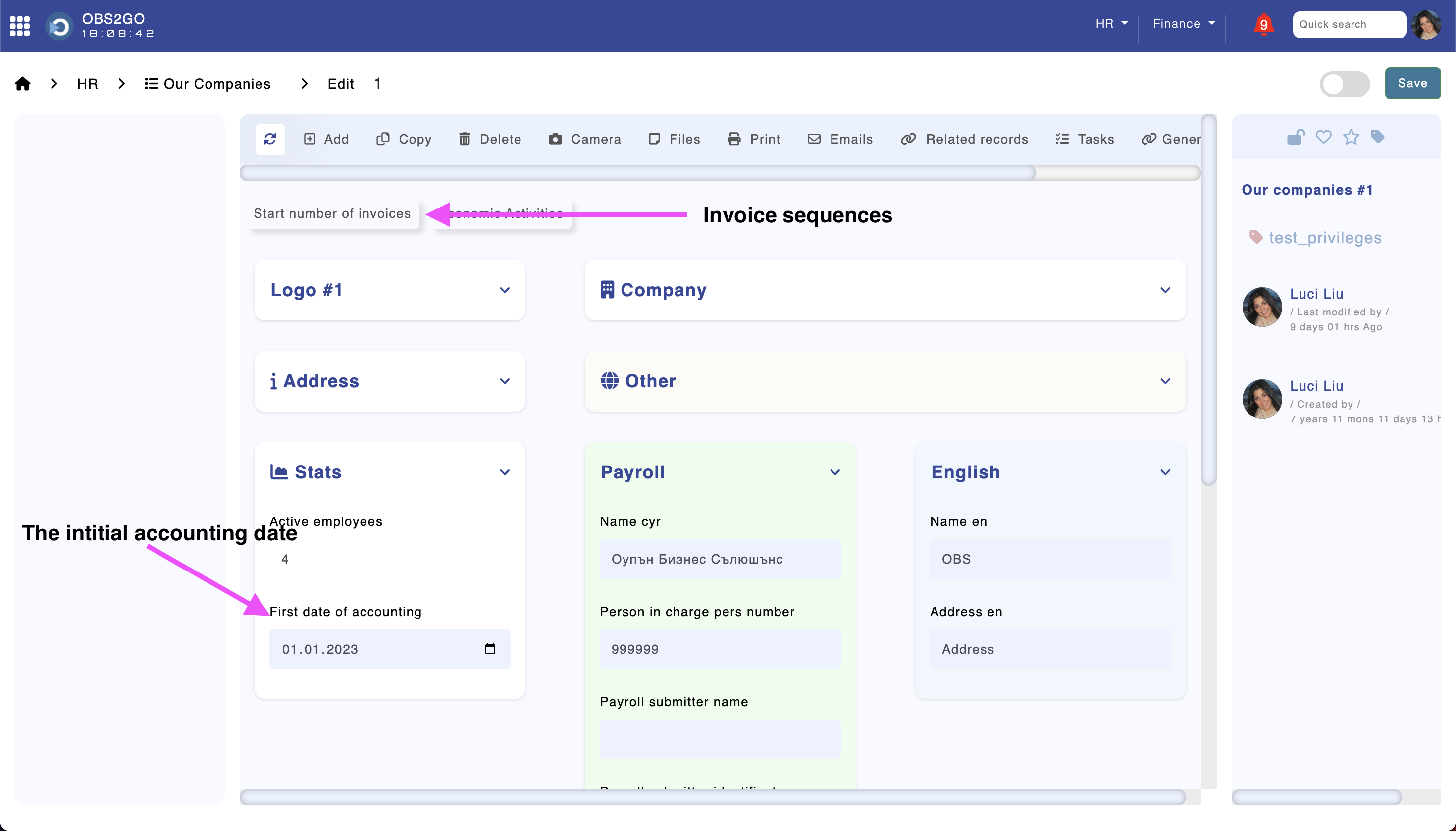

First date of accounting & Invoice sequences

The invoice sequences can be configured in module "Our companies".

Module "Our companies"

- First date of accounting - All accounting entries will be ignored before this date;

- Start number of invoices - You can have multiple invoice sequences for every company you operate

Initial balance

The initial balance per ledger account can be set in module "Ledger accounts".

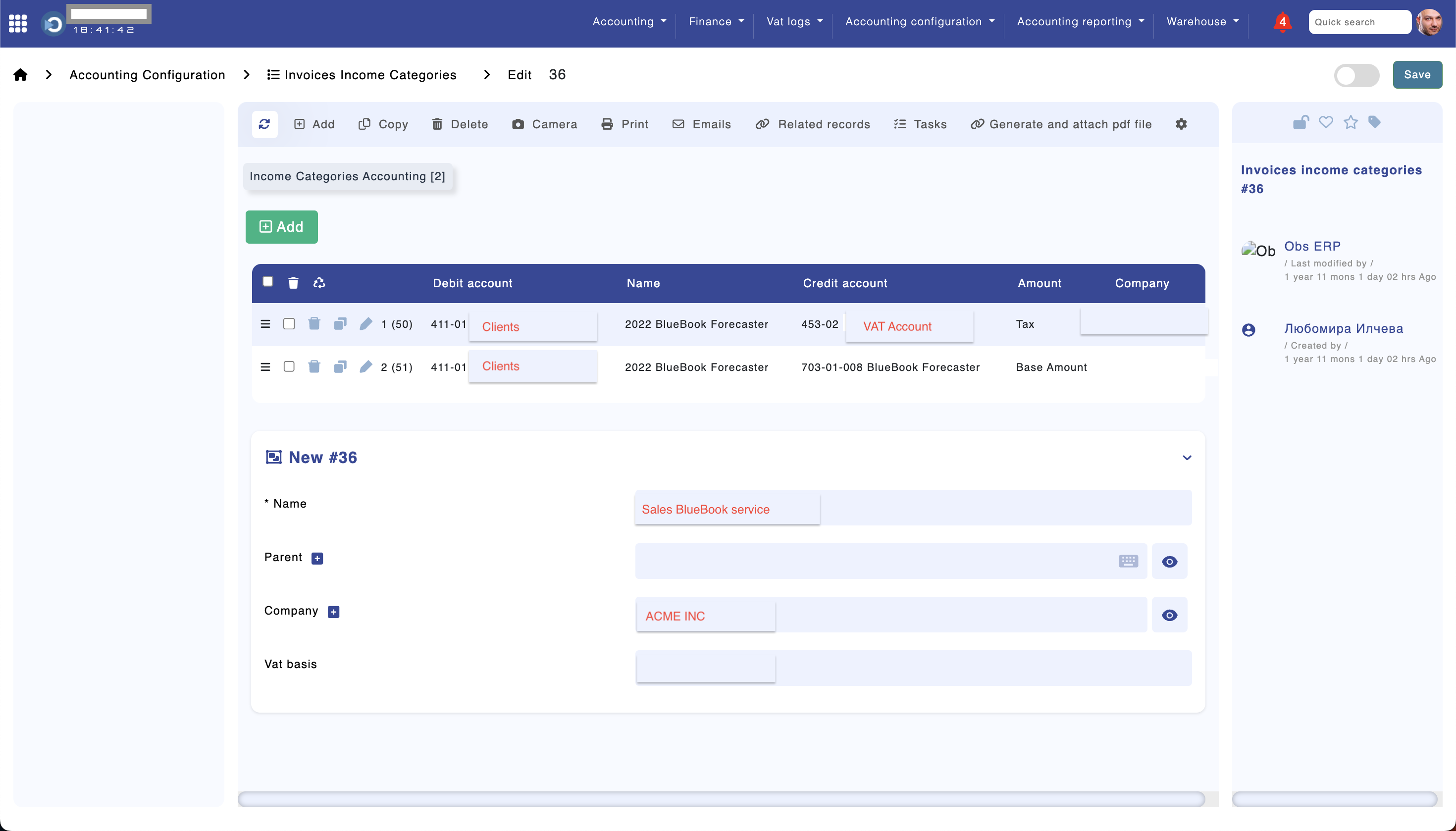

Accounting templates - income

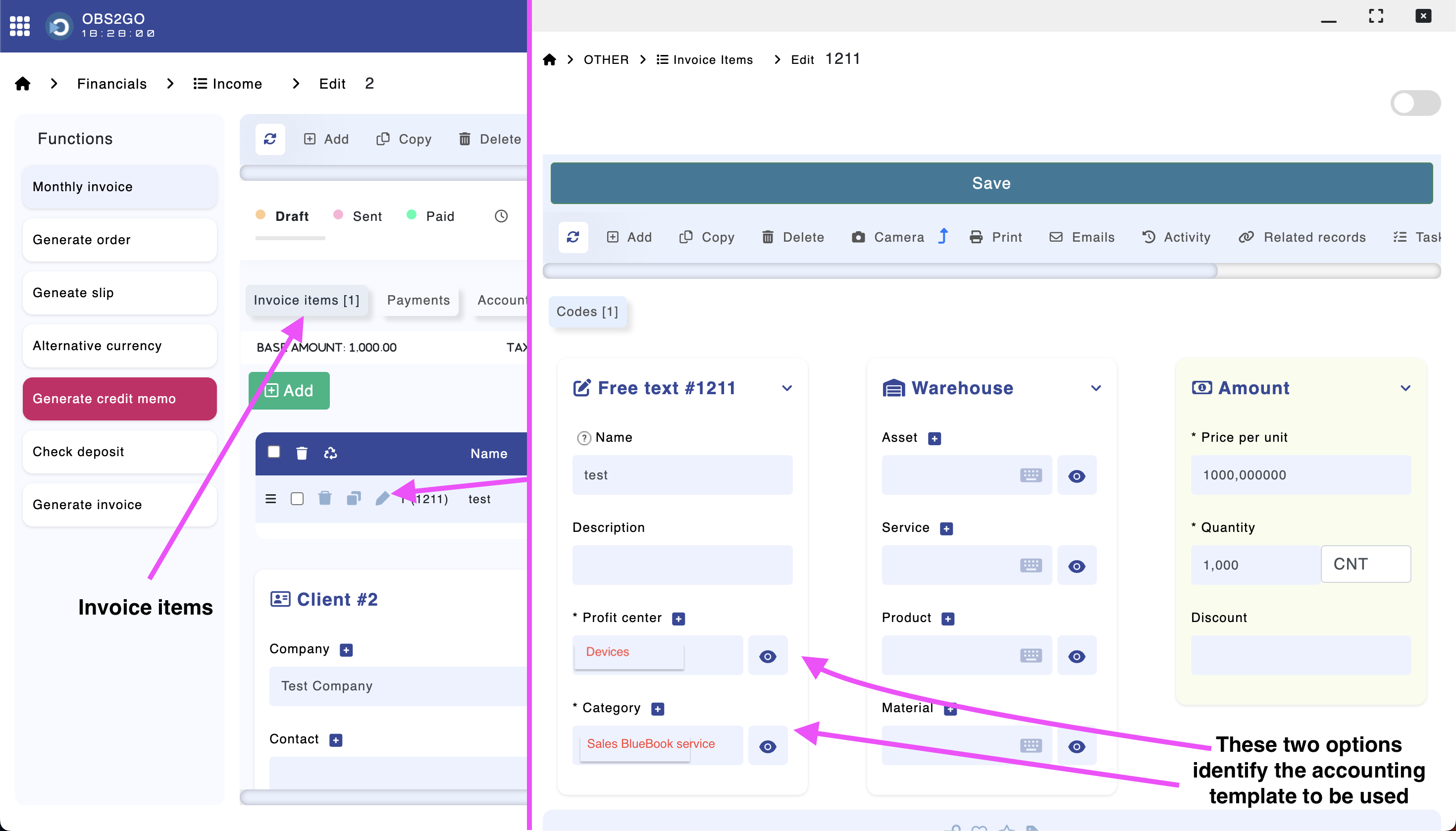

The templates for automatic accounting allow you to automatically post documents based on a selected profit center and income category.

Income categories

In the example below, we have created an income category called "Sales BlueBook Service." When this income category is selected in the "Invoices" module, the system will post the document as follows:

- Base amount

- 411-01 debit

- 703-01-008 credit

- Tax amount

- 411-01 debit

- 453-02 credit

Module "Income categories"

Profit centers

The profit center is used to identify which ledger account should be used when posting an income document.

Module "Cost locations"

When the income categories and profit/cost centers have been populated, the system is ready to post a document. The figure below displays an income document created in the 'Invoices' module.

Module "Invoices"

In summary: To post an income document:

- Create general ledger accounts

- Create income categories

- Create profit/cost centers

- Create an income document in the module "Invoices"

- Add items to the document, selecting income category and profit center

- Click the "Accounting" button to create the postings

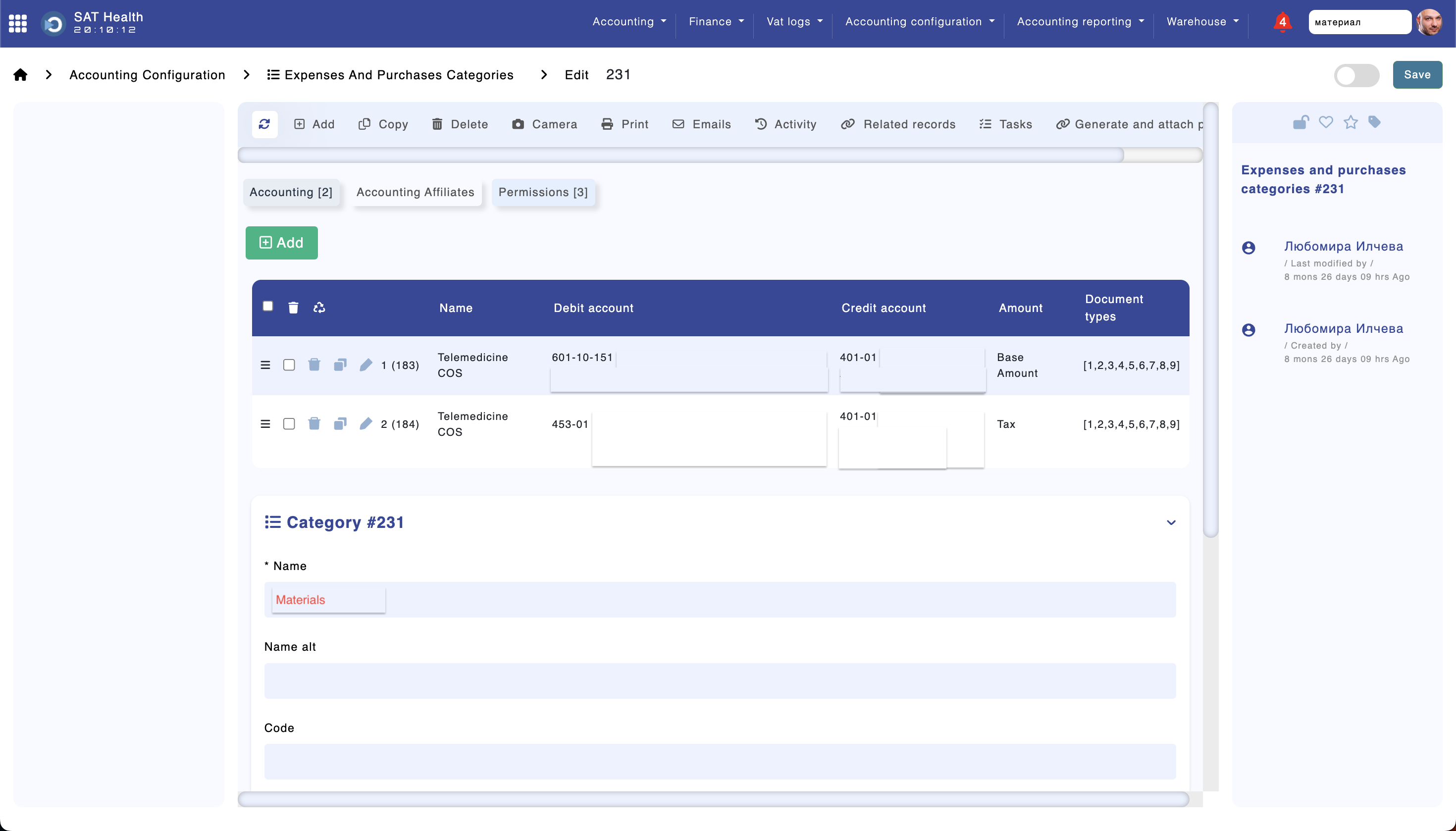

Accounting templates - expenses

The templates for automatic accounting allow you to automatically post documents based on a selected cost center and expense category.

Expense & Purchase categories

In the example below, we have created an expense category called "Materials." When this expense category is selected in the "Expenses" module, the system will post the document as follows:

- Base amount

- 401-01 credit

- 601-10-151 debit

- Tax amount

- 401-01 credit

- 453-01 debit

Module "Expense & purchase category"

Cost centers

The cost center is used to identify which ledger account should be used when posting an expense document.

Module "Cost locations"

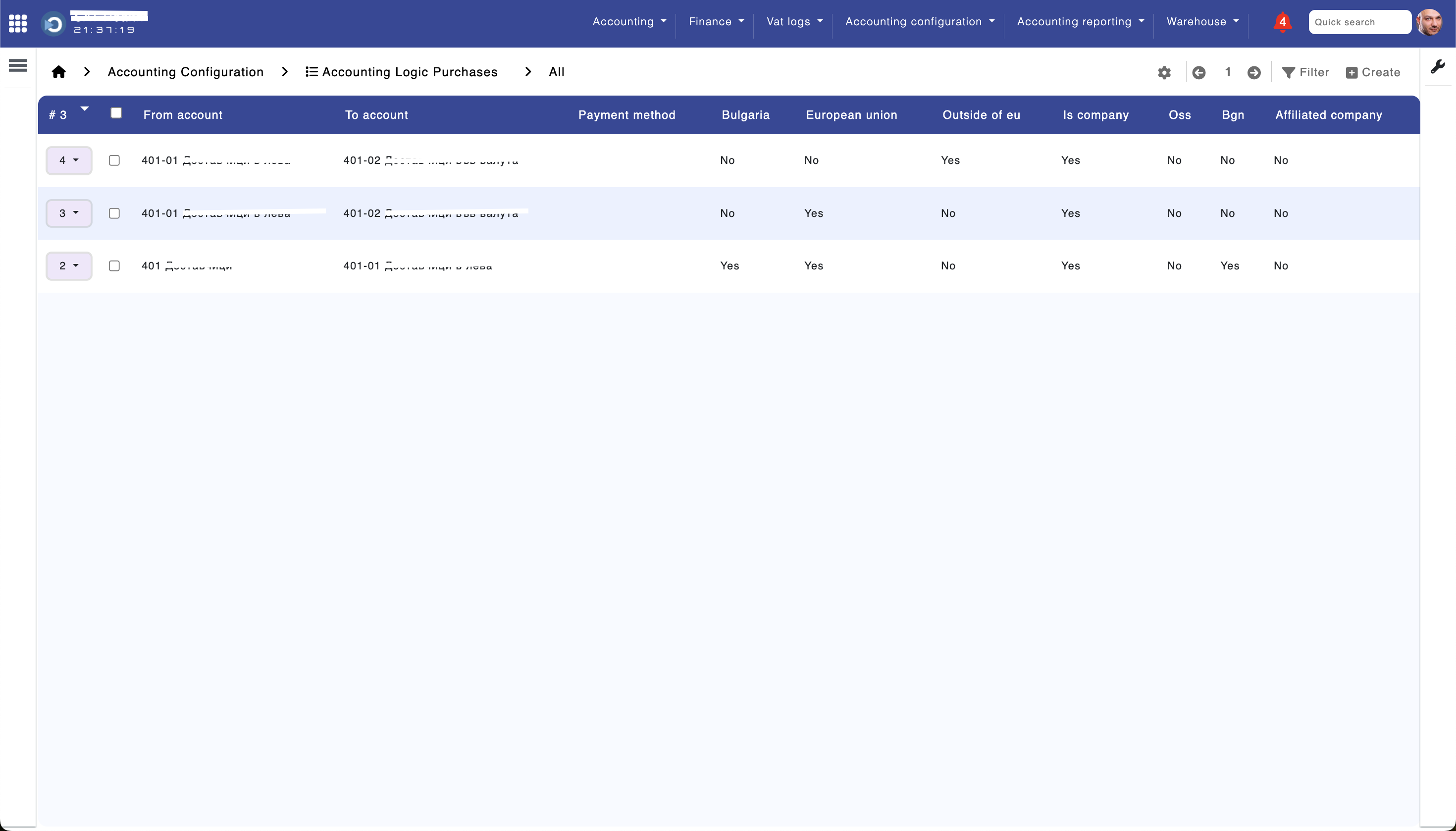

Accounting logic - expenses

You can configure rules to alter the ledger account used for a posting when specific conditions are fulfilled. In the example below, the system will alter the ledger account as follows:

- Base account 401-01 will be altered to 401-02 if the following conditions are met:

- The client is outside of EU

- The client is a legal entity

Module "Accounting Logic Purchases"

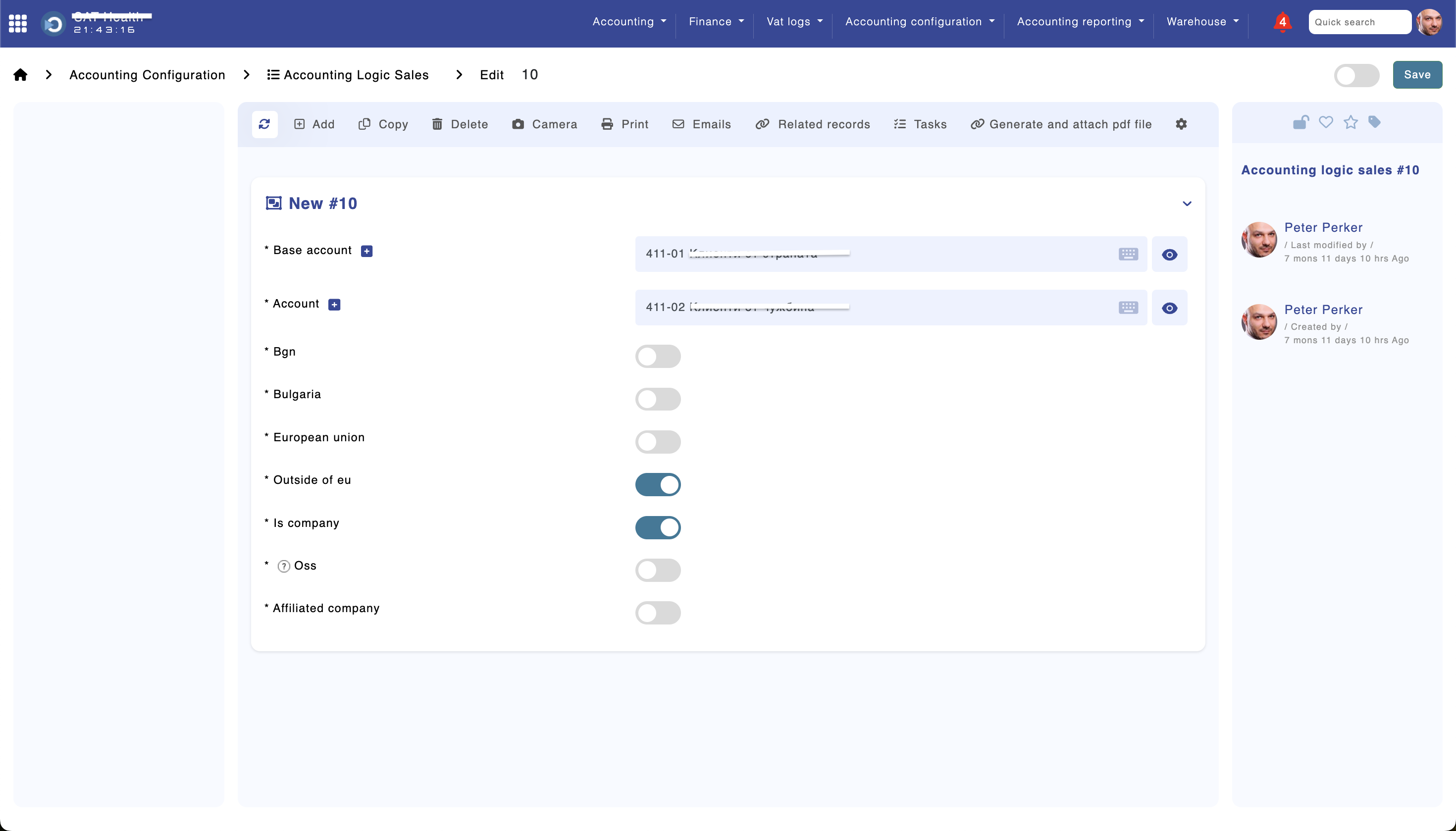

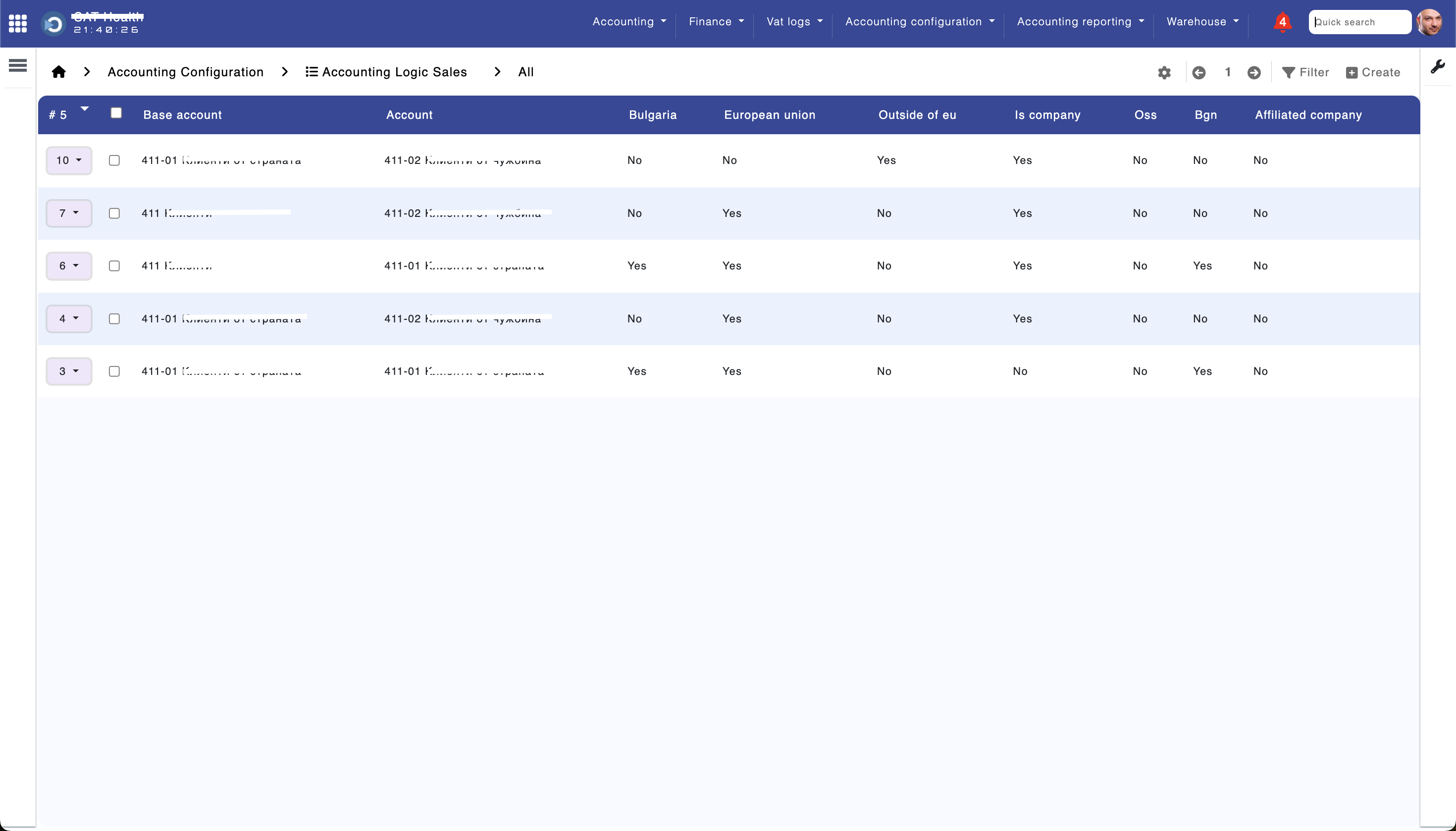

Accounting logic - invoices

You can configure rules to alter the ledger account used for a posting when specific conditions are fulfilled. In the example below, the system will alter the ledger account as follows:

- Base account 411-01 will be altered to 411-02 if the following conditions are met:

- The client is outside of EU

- The client is a legal entity

Module "Accounting logic - invoices"

Some more examples:

Module "Accounting logic - invoices"