Accounting

/Long term tangible assets

Long term tangible assets

The "Long term tangible assets" module focuses on tracking, valuation, depreciation, and accounting for the fixed assets owned by an organization. Here's the list of features:

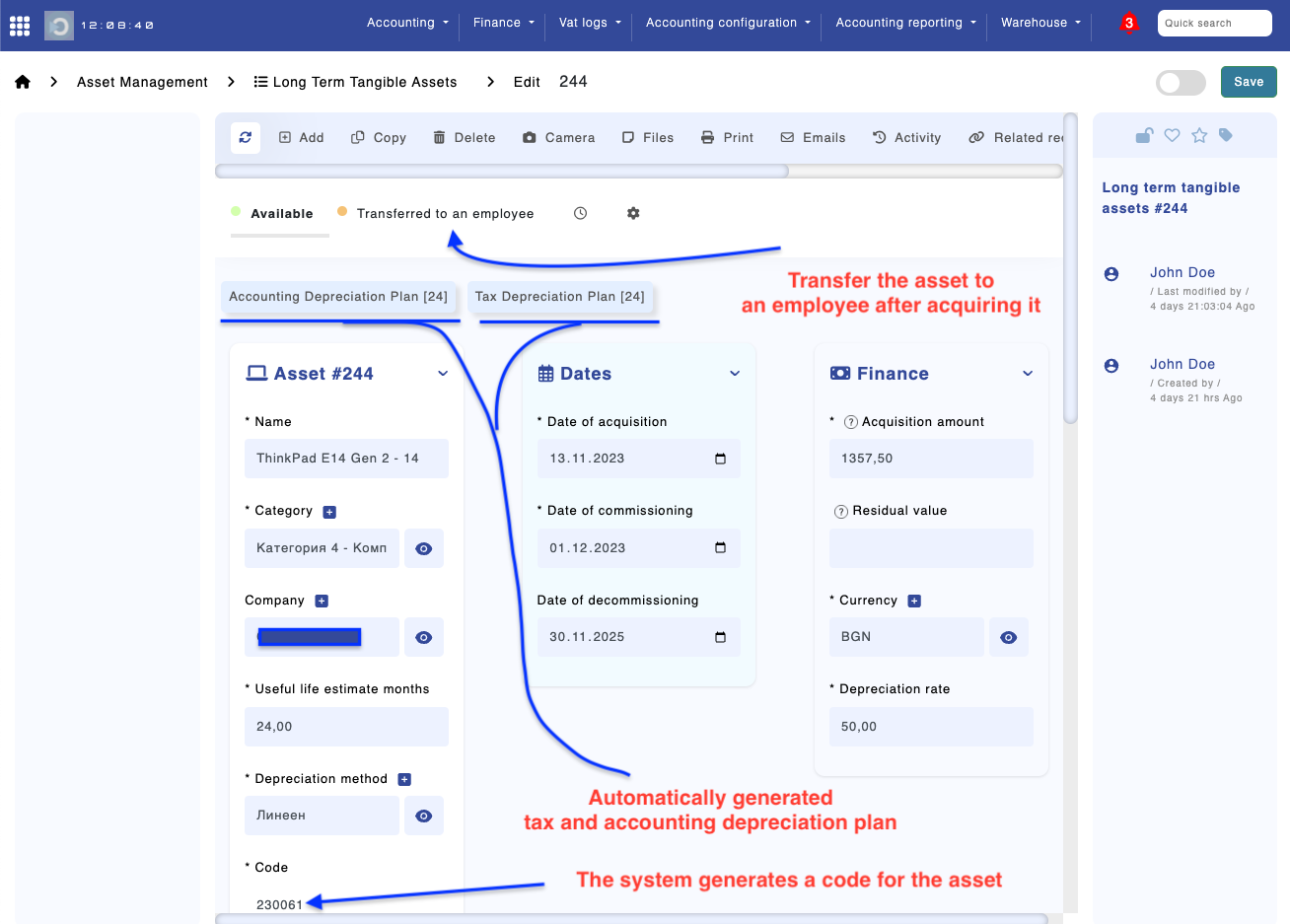

Module "Long term tangible assets" - mode "Edit"

Assets register

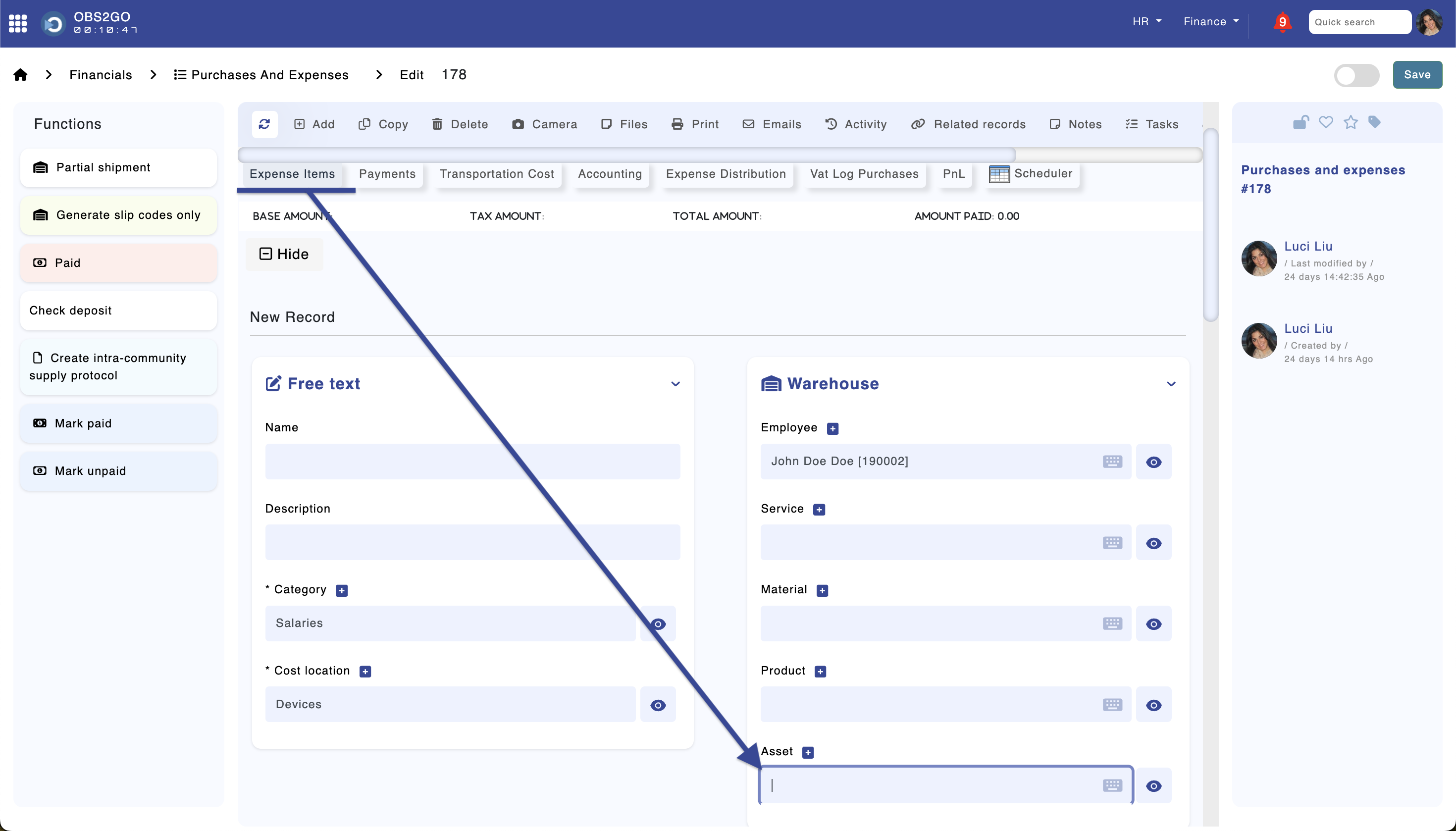

The company assets can be registered in the "Long term tangible assets" module. The system will generate a unique code for the asset, along with tax and accounting depreciation schedules. The cost for acquiring the asset can be recorded in module "Purchases and Expenses" > "Line items".

Module "Purchases and expenses"

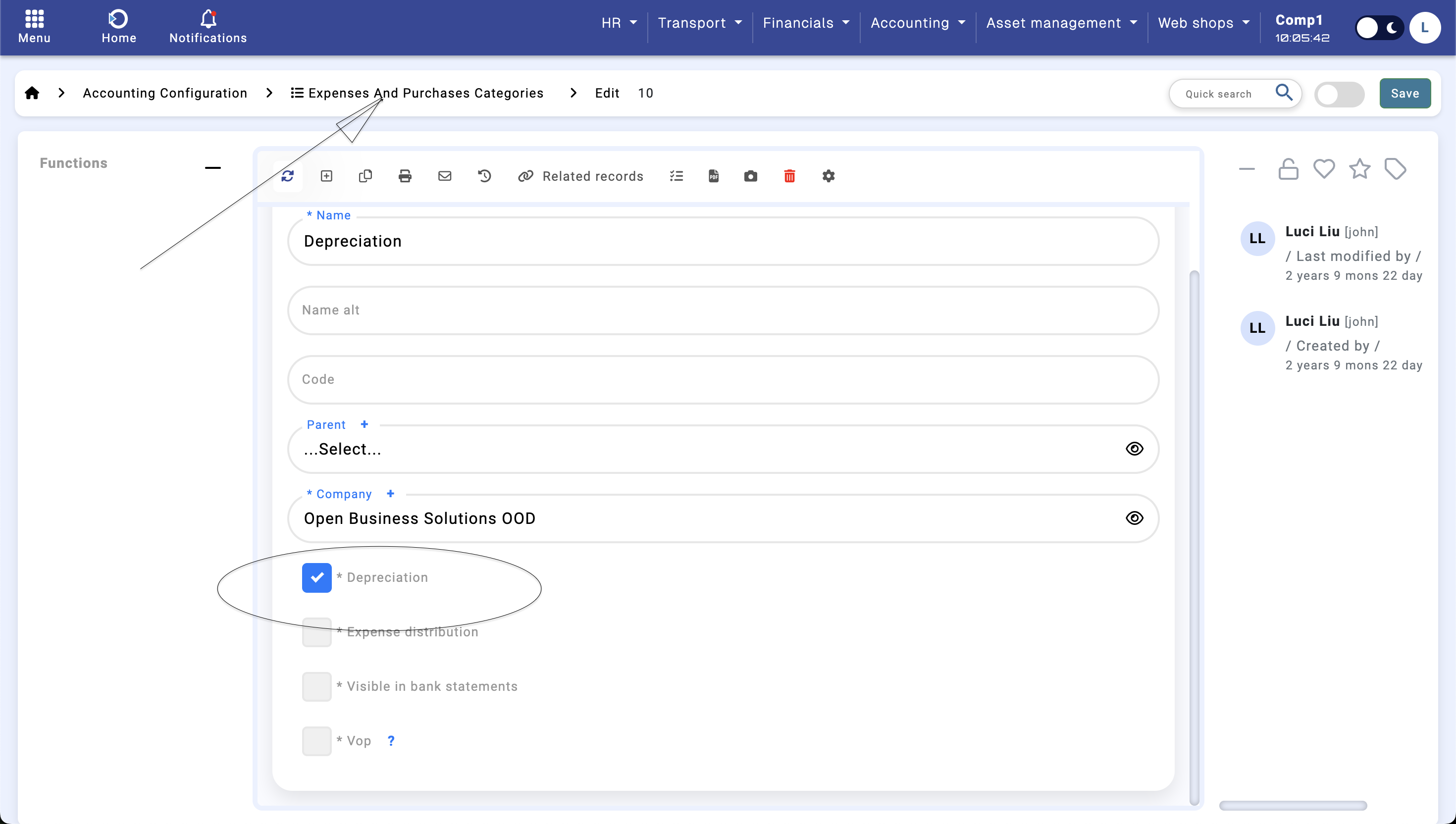

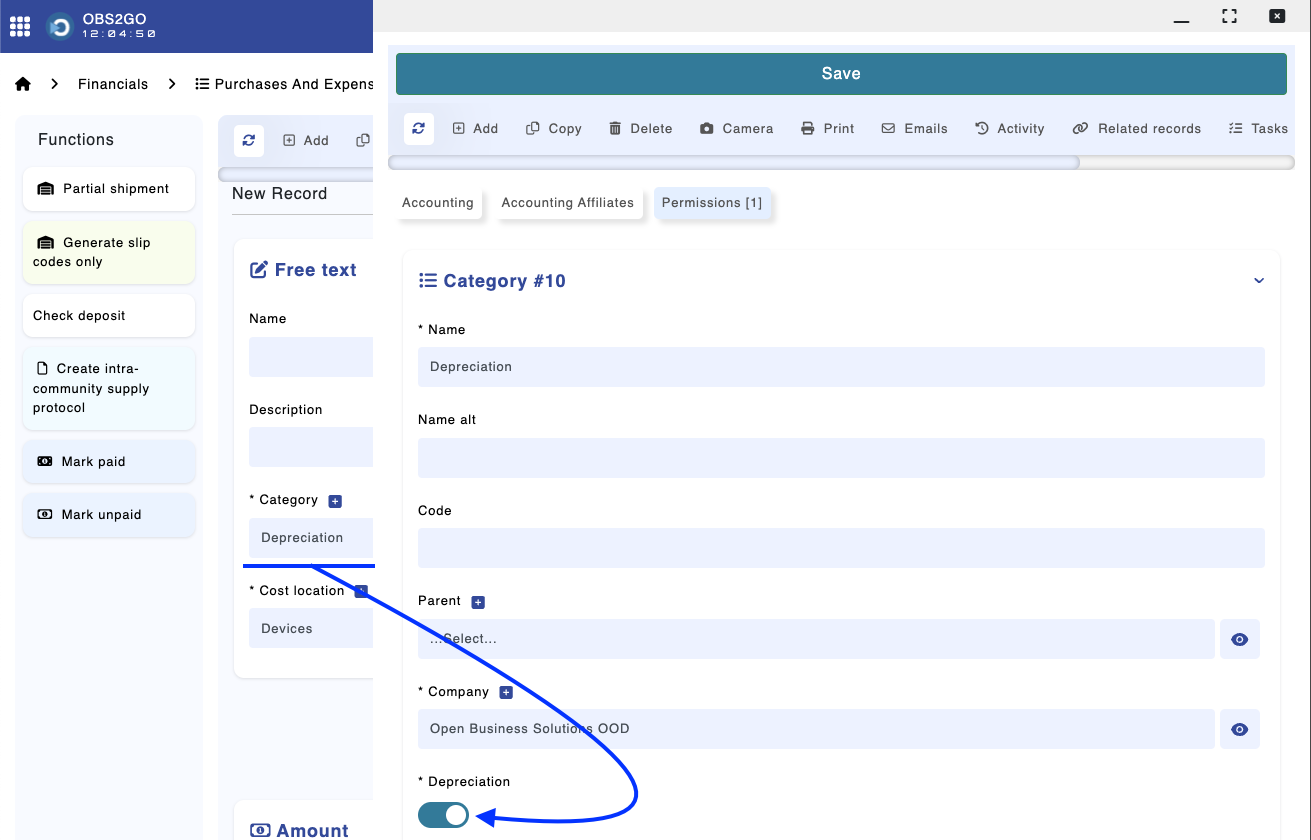

Depreciation

Depreciation is automatically posted on a monthly basis by the system. The resulting depreciation entries are accessible in the "Purchases and Expenses" module. A special category within this module designates the records for depreciation, and you can filter the documents by category. The posting configuration is done in the category settings.

Module "Purchases and expenses" - mode "Edit"

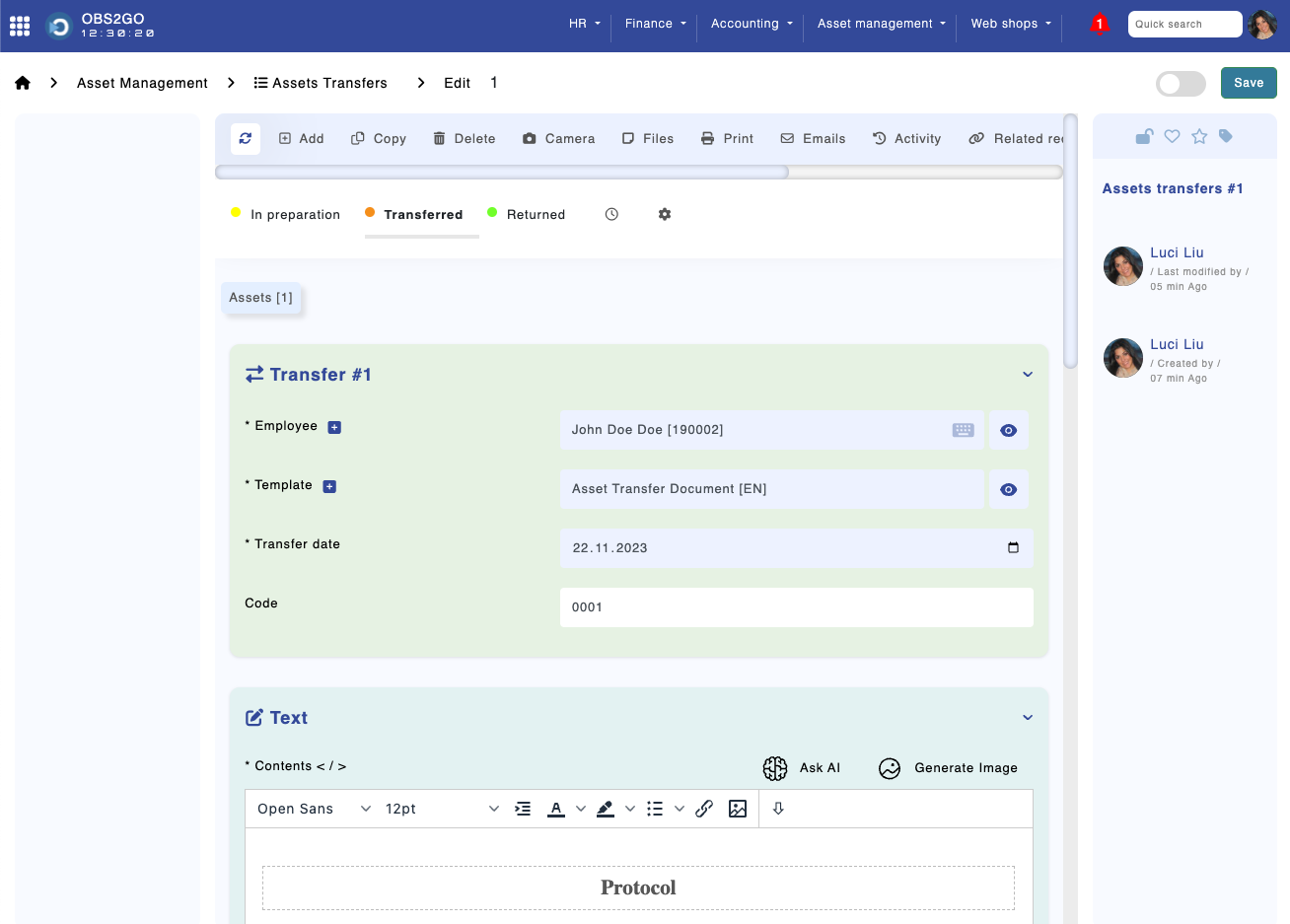

Transferring of an asset to an employee

After registering an asset, you can transfer it to an employee by issuing a transfer protocol.

- Open module "Asset Transfers".

- Create an asset transfer and select the assets you would like to transfer.

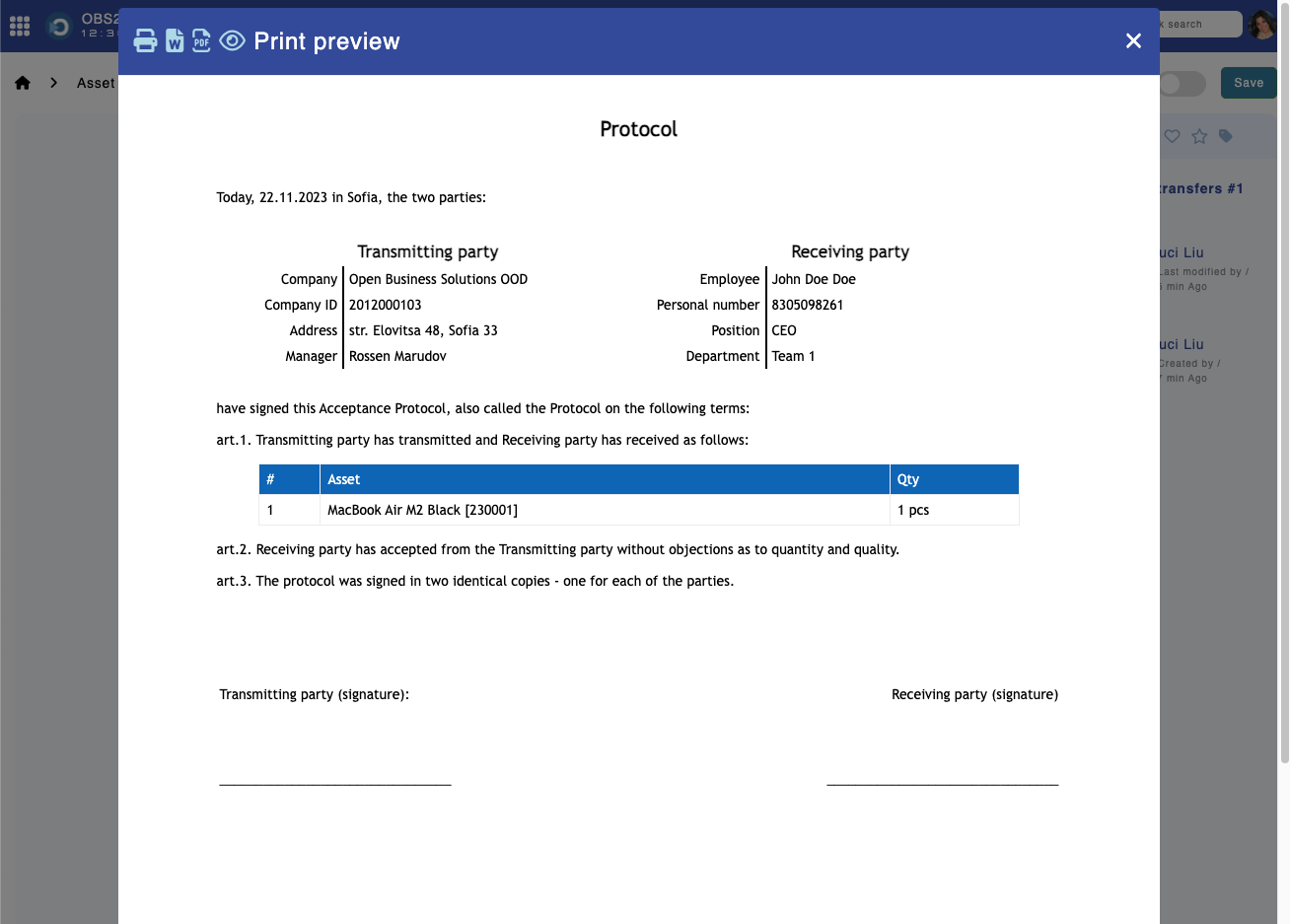

- The system will generate an asset transfer protocol.

- Click "Transferred" to complete the process.

Module "Asset transfers" - mode "Edit"

Module "Asset transfers" - Asset transfer protocol

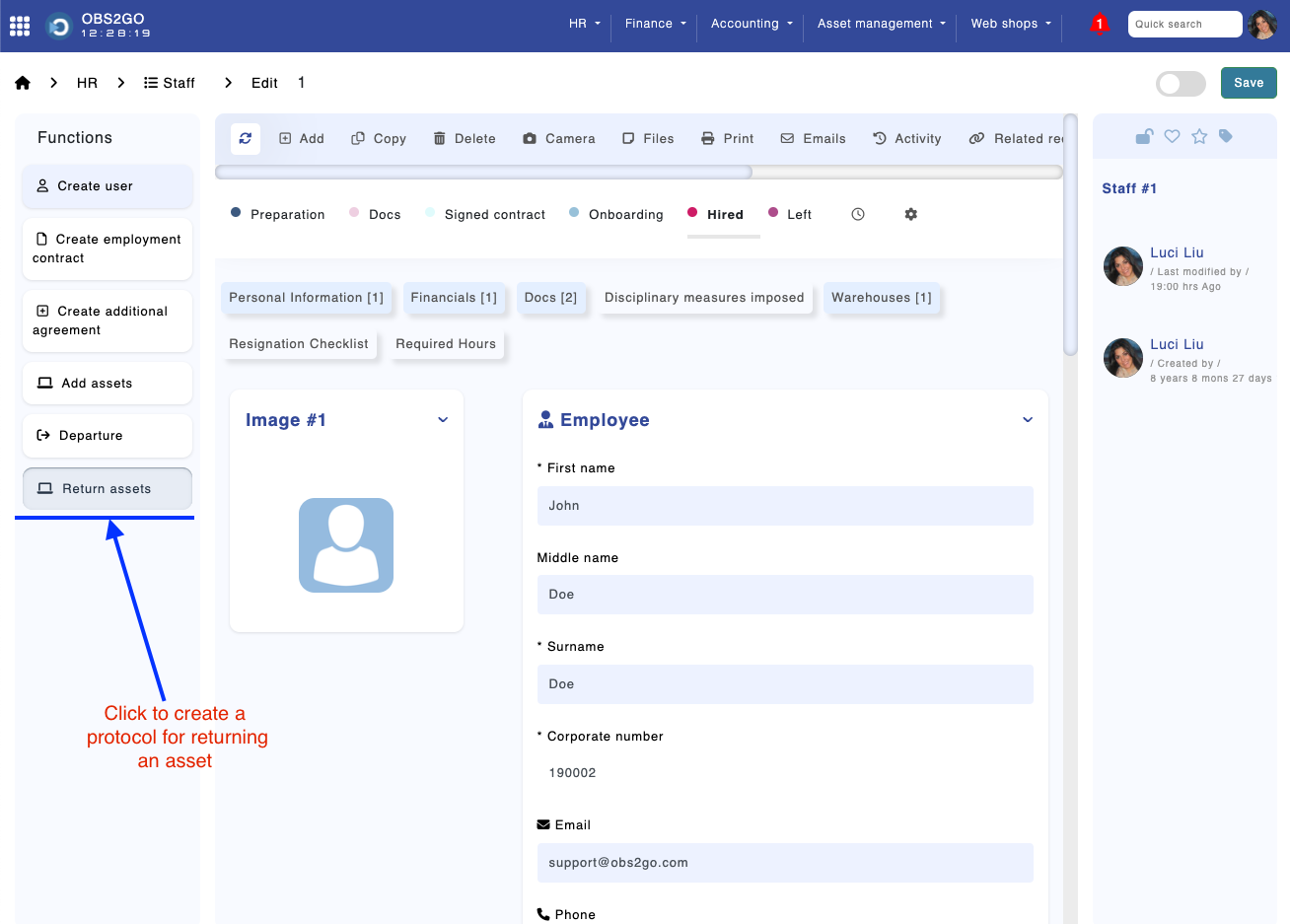

Returning an asset from an employee

Follow these steps to return assets from an employee:

- Open module "Staff".

- Find and open the employee profile.

- Click the "Return assets" button.

- The system will generate a record in the "Asset transfers" module.

- Open the record and click "Returned" to change the status of the assets to "Available".

- The system generates a return protocol.

Module "Staff" - Edit record

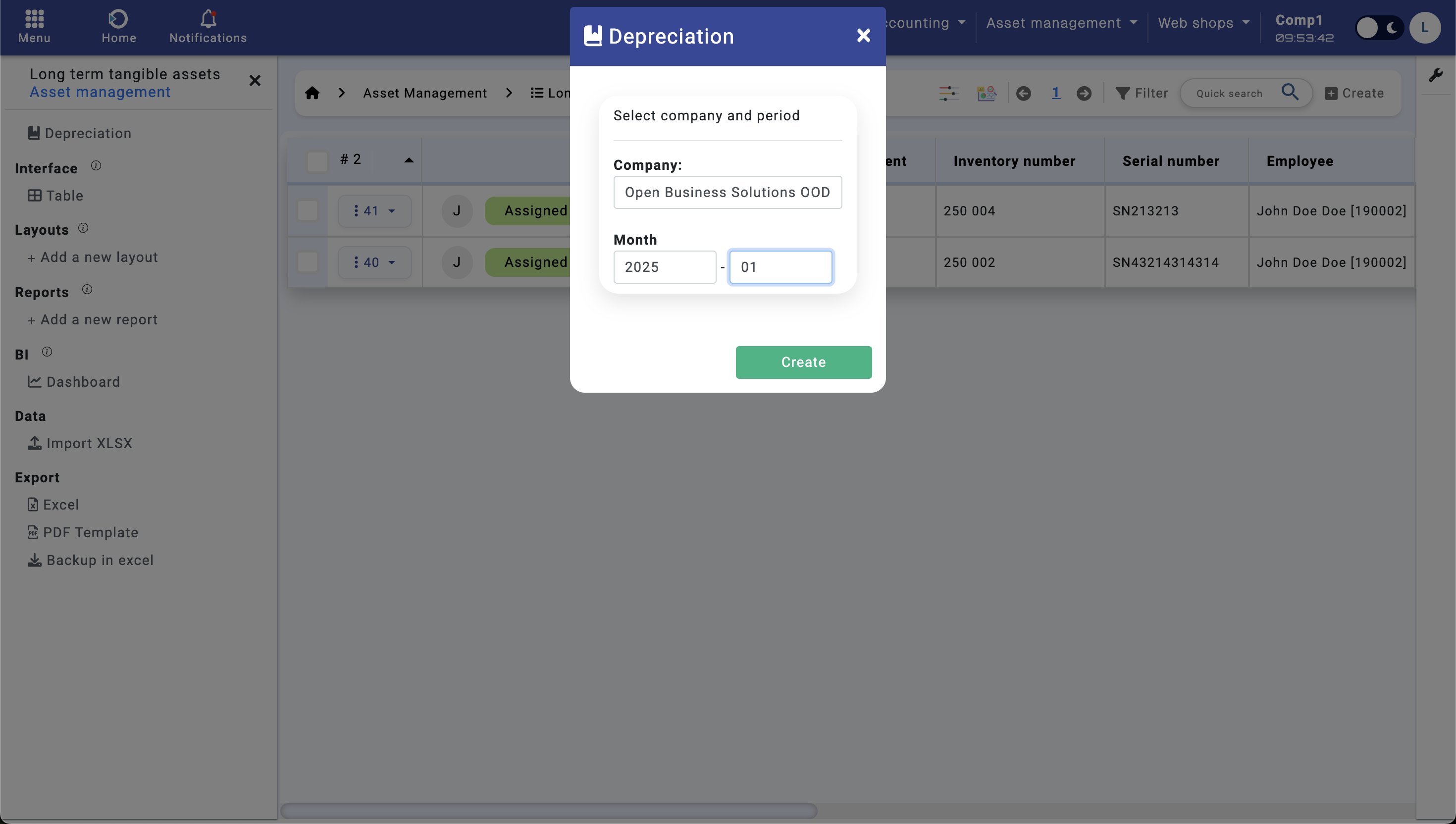

Running depreciation

Follow these steps to run monthly depreciation:

- Open module "Long term tangible assets"

- Click "Depreciation" as shown below

- Choose company and month and click "Create"

This operation will create records in module "Expenses".

Prerequisites: you need to have a depreciation category in module "Expenses and purchases categories" as shown below.