Accounting

/VAT

Sales Log

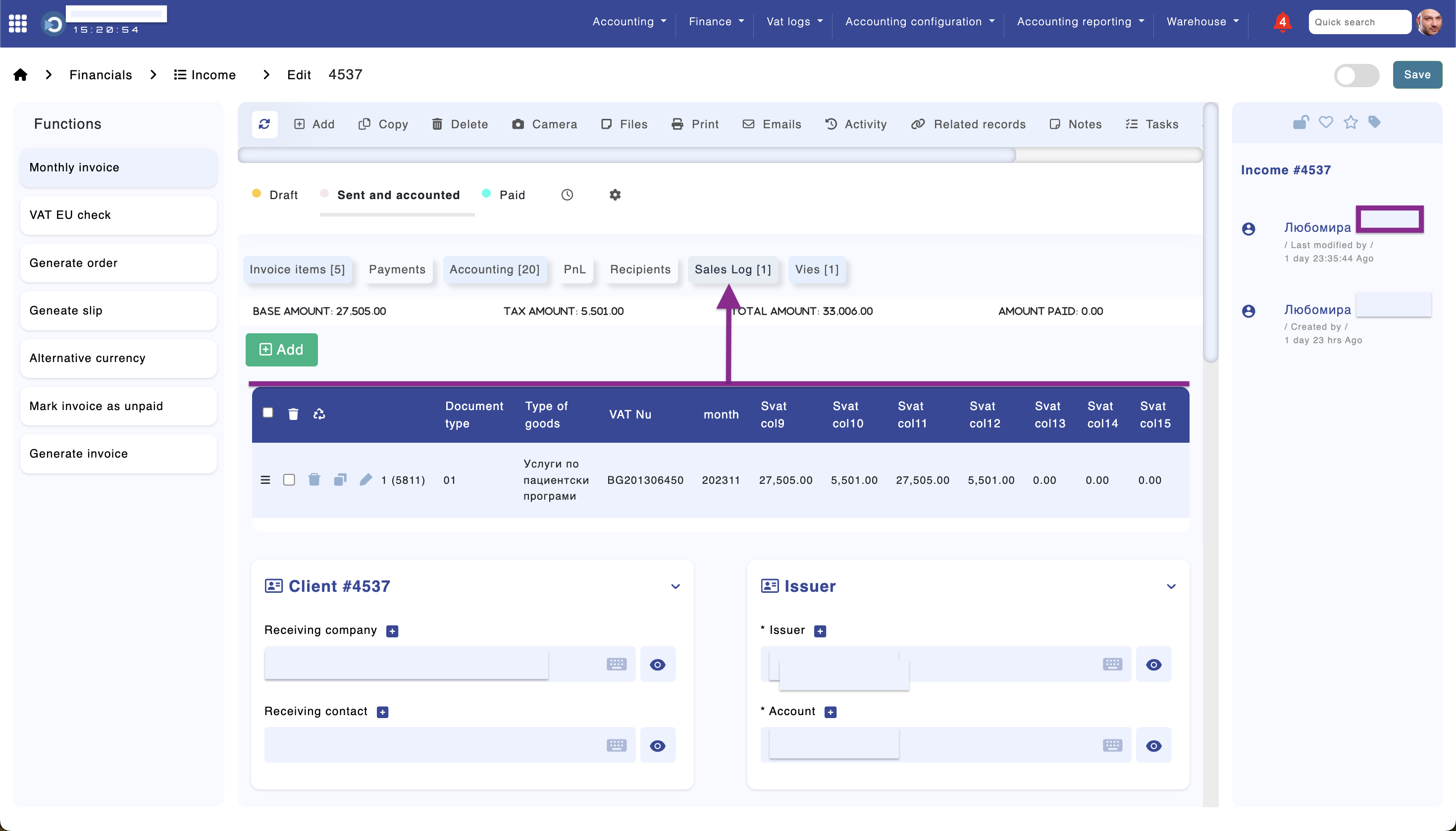

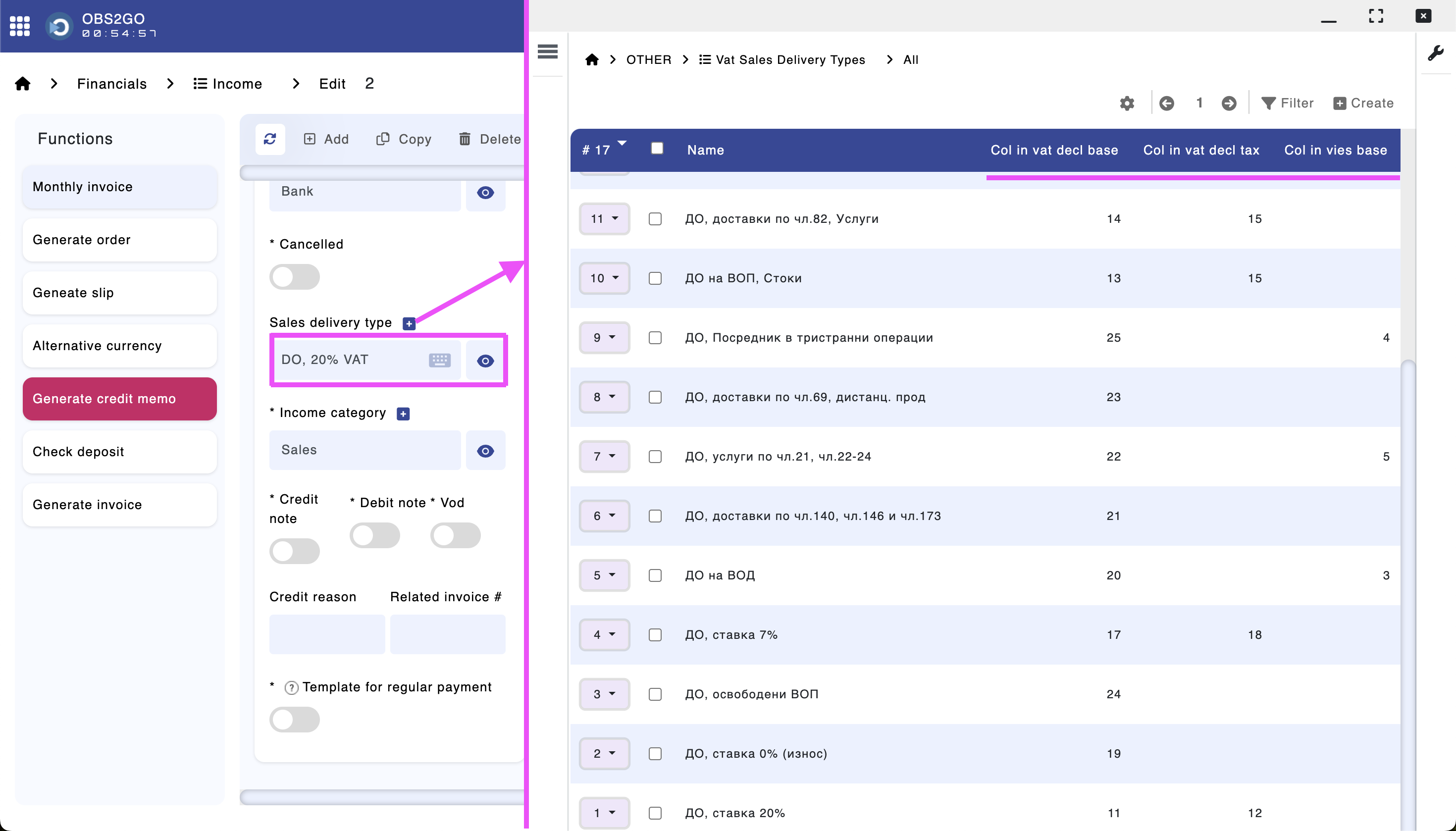

The system is capable of generating a log of all sales subject to VAT. The 'Sales Delivery Type' option in the 'Invoices' module is used to determine the column in the sales log where the base amount and the tax amount will be recorded. The figure below displays an example configuration compatible with the Bulgarian tax law:

Module "Invoices"

The sales log is populated upon the completion of the document posting.

Real-time sales log

It is located in the "VAT" section > "VAT Sales - Real Time".

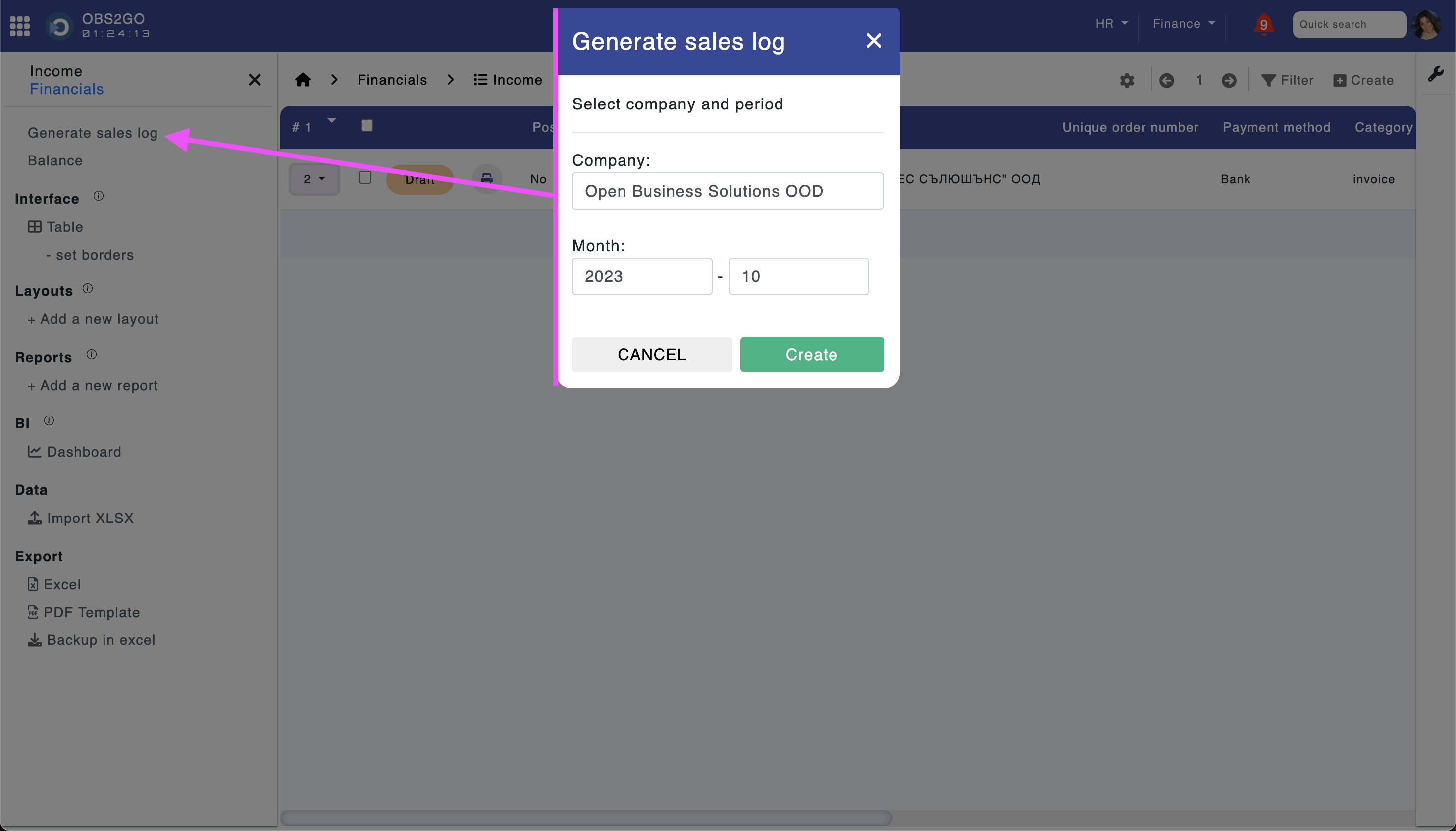

Generating a sales log for the Bulgarian income agency

Open module "Invoices" > click "Generate a sales log".

Module "Invoices"

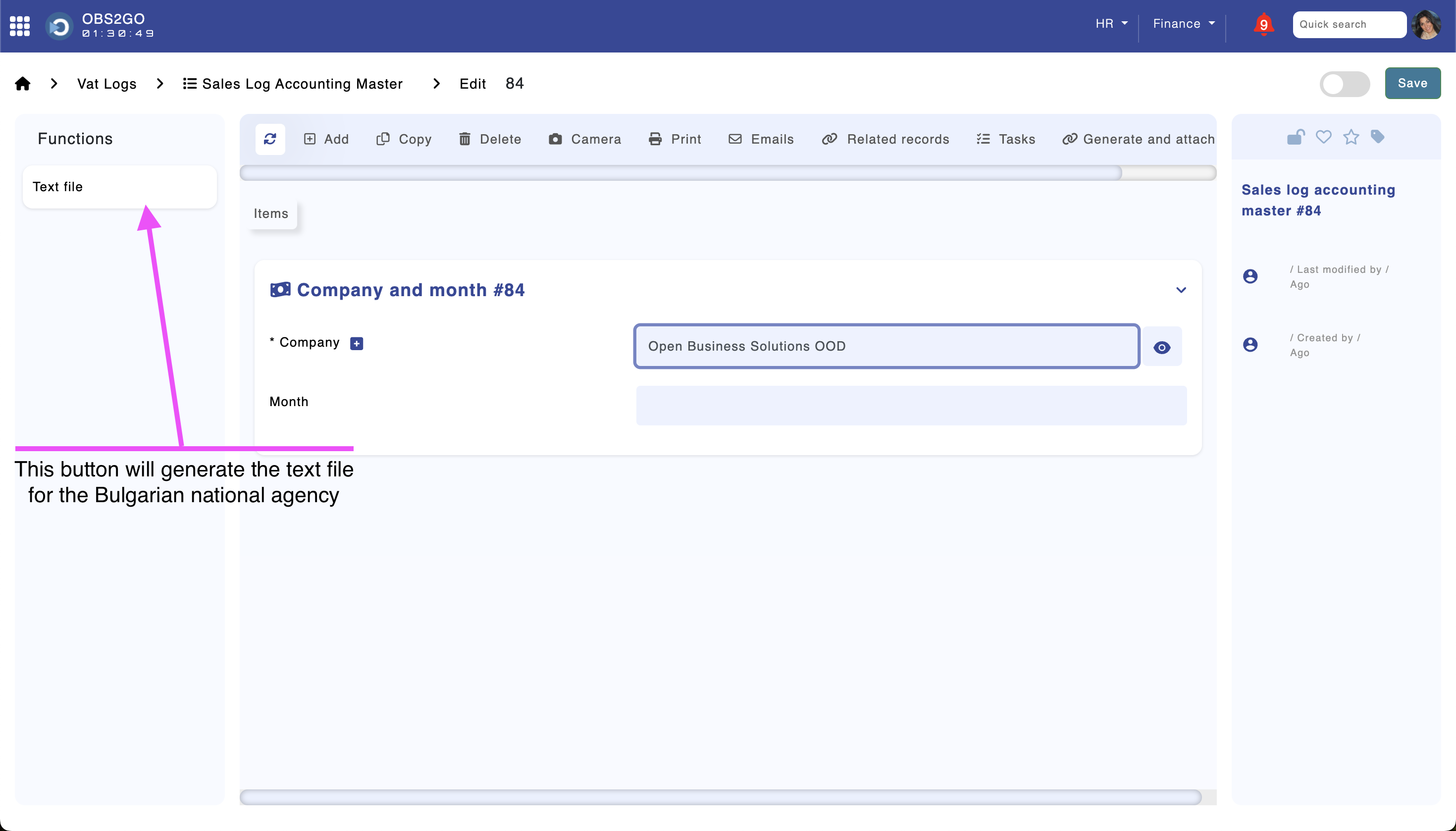

The resulting sales log will be stored in section "VAT" > "Sales Log Accounting Master". The text file for the Bulgarian national income agency can be generated as displayed below:

Module "Sales Log Accounting Master"

Month Format: MM.YYYY (Example: 09.2023)

The income documents include a button that can display how the base and total amounts are recorded in the sales log.