Asset management

/Long-Term Tangible Assets

Long-Term Tangible Assets

The Long-Term Tangible Assets module is a versatile tool that can be used for various purposes:

- Accounting purposes: Tracking asset acquisition, depreciation, and financial attributes.

- Employee assignment: Managing assets assigned to employees.

- General asset management: Keeping a detailed record of assets and their statuses.

This module allows for the combined management of these functions or focuses on a specific aspect as needed.

Adding a New Asset:

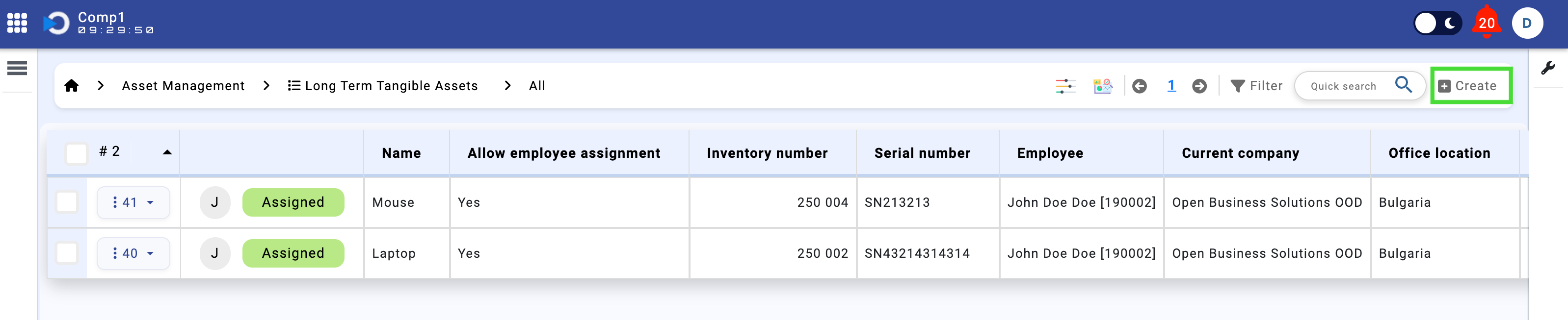

To add a new asset, navigate to the Long-Term Tangible Assets module.

By default, the table with existing assets will be displayed.

To create a new asset, click "Create" and fill in the required details.

Long-Term Tangible Assets -> Creation of Long-Term Tangible Asset

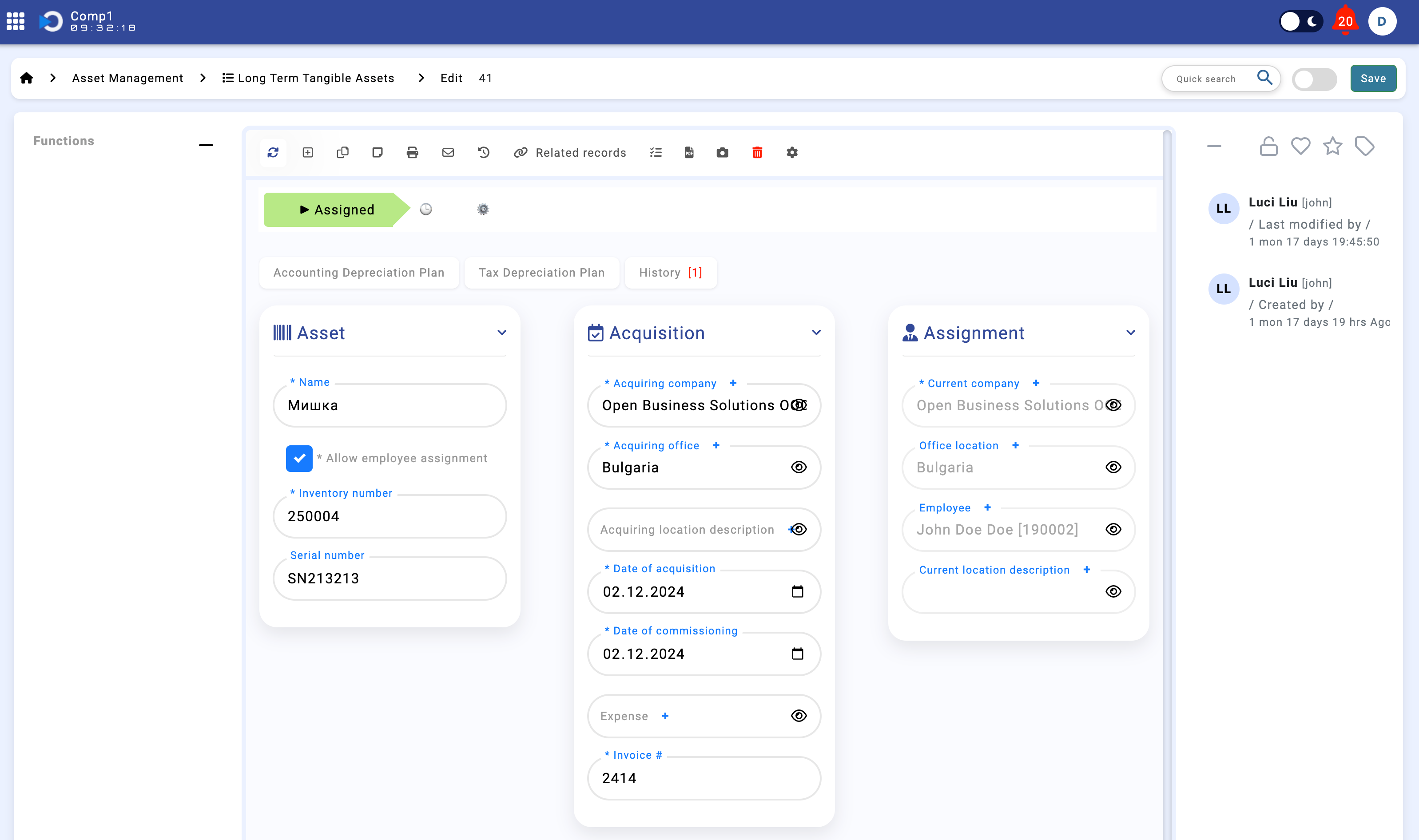

Fields and Attributes

General Fields

- Name: The name of the asset.

- Allow Employee Assignment:

- A checkbox indicating if the asset can be assigned to employees.

- If checked, the asset is transferable to employees.

- If unchecked, the asset is for communal or specific office use.

- Inventory Number: A unique identifier for the asset within the organization.

- Serial Number: The manufacturer's serial number of the asset.

- Acquiring Company: The organization responsible for the asset and where it is accounted.

- Acquiring Office: The office where the asset is initially located.

- Acquiring Location Description: A dropdown field specifying detailed locations within the office, such as rooms or areas.

- Date of Acquisition: The date the asset was acquired.

- Date of Commissioning: The date the asset started being used.

- Expense: A reference to the Expense module linking the specific expense related to the asset's purchase.

- Invoice Number: The invoice number provided by the supplier for the asset.

Assignment-Related Fields

- Current Company, Office Location, Employee, and Location Description:

- These fields are automatically updated by the asset transfer processes.

- They represent the current status of the asset in terms of ownership, location, and assignment.

Asset Status

Each asset has a status that is automatically updated based on its attributes and state:

- General Asset: If the Allow Employee Assignment checkbox is unchecked, the asset is designated as a general asset for communal or office use.

- Vacant: If the Allow Employee Assignment checkbox is checked, but the asset is not currently assigned to any employee, its status is "Vacant."

- Assigned: If the Allow Employee Assignment checkbox is checked and the asset is currently assigned to an employee, its status is "Assigned."

- Retired: If the asset has been decommissioned, its status is automatically updated to "Retired."

Categorization

- Category: The accounting category of the asset.

- Internal Category: A customizable field where each client can define their internal classification for assets.

- Decommissioning:

- A checkbox indicating whether the asset is decommissioned.

- Includes a field to specify the Date of Decommissioning.

Financial and Accounting Attributes

- Useful Life Estimate (Months): The expected useful life of the asset in months.

- Depreciation Method: The system supports the linear depreciation method.

- Acquisition Amount: The initial cost of acquiring the asset.

- Residual Amount: The expected value of the asset at the end of its useful life.

- Currency: The currency in which the asset's value is accounted.

- Depreciation Rate: The annual depreciation rate for the asset.

- Accounting Depreciable Value: Calculated as:

- Acquisition Amount - Residual Amount

- Tax Depreciable Value: The value considered for tax purposes.

- Depreciable Quota: The amount allocated for depreciation.

- Account: The general ledger account associated with the asset.

- Account Depreciation: The account category for the automated depreciation expenses.

- Balance Amount:

- The book value of the asset after deducting accumulated depreciation and any impairment losses.

- Translated from Bulgarian: "The balance amount is the value at which an asset is recognized in the balance sheet after deducting all accumulated depreciation and accumulated impairment losses."

Additional Fields

- Comment: A free-text field where users can add additional information about the asset.

- Log: A field for users to log comments or updates related to the asset.

Transfer-Related Fields

- First Transfer to Employee:

- A read-only field that records the date of the first transfer of the asset to an employee.

- Automatically updated by the transfer processes.

- Last Transfer to Employee:

- A read-only field that records the date of the most recent transfer of the asset to an employee.

- Automatically updated by the transfer processes.

Figure: Long-Term Tangible Assets fields

Depreciation Posting

The depreciation process in the OBS system ensures accurate and automated tracking of asset depreciation over time. It is designed to comply with accounting standards and streamline the posting of depreciation expenses.

Key Concepts

- Depreciation Plans:

- The system maintains two types of depreciation plans: Accounting Depreciation Plan and Tax Depreciation Plan.

- These plans calculate monthly depreciation amounts based on the asset's acquisition value, useful life, and residual value.

- Trigger-Based Automation:

- Whenever an asset is created or updated in the Long-Term Tangible Assets module, a trigger automatically recalculates the depreciation plans.

- The trigger ensures that:

- Monthly depreciation amounts are calculated for each asset.

- Remaining useful life is adjusted dynamically.

- Depreciation entries are stored for future posting.

- Depreciation Calculation:

- Depreciation is calculated using the following formula:

- Monthly Depreciation Amount = (Acquisition Amount - Residual Value) / Useful Life Estimate