Asset management

/Reports

Reports

The available reports provide clear insights into asset movements, current statuses, and financial depreciation, helping organizations manage their assets effectively.

Movement Report

The Movement Report tracks asset transfers over a specified period, offering a detailed history of asset movements.

Key Features

- Date Range Filter: Select a start and end date to view movements within a specific timeframe.

- Asset Selection: Filter by specific assets to focus on relevant data.

- Comprehensive Details: The report includes:

- Asset details, such as name, code, and serial number.

- Transfer details, including the "From" and "To" employees, companies, and offices.

- Timestamp of when the transfer was completed.

How It Works

The system retrieves transfer data from the asset history, applying the selected filters. If no specific assets are chosen, all transfers within the date range are displayed. This report helps organizations monitor asset usage, trace movements, and maintain accurate records for audits.

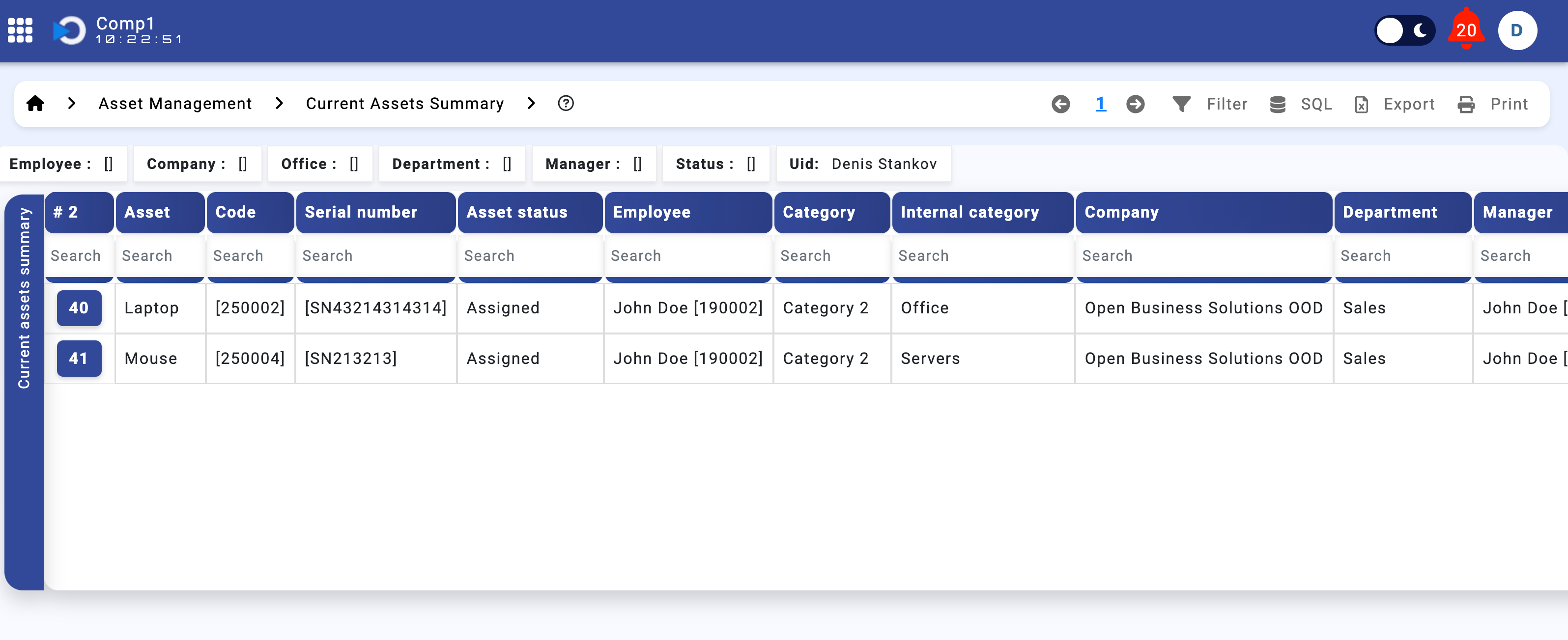

Current Assets Summary

The Current Assets Summary provides a real-time snapshot of all active assets, their current holders, and statuses.

Key Features

- Flexible Filters: Refine the report by employee, company, office, department, manager, or asset status.

- Detailed Data: Each record includes:

- Asset details, such as name, code, serial number, and status.

- Current holder information (employee, office, company).

- Categorization, including accounting and internal categories.

- Real-Time Insights: Helps organizations understand asset distribution and identify gaps or inefficiencies.

How It Works

The system retrieves active asset data, applying the selected filters to display relevant information. This report is crucial for inventory checks, planning, and ensuring compliance with asset management policies.

Current Assets Summary Report

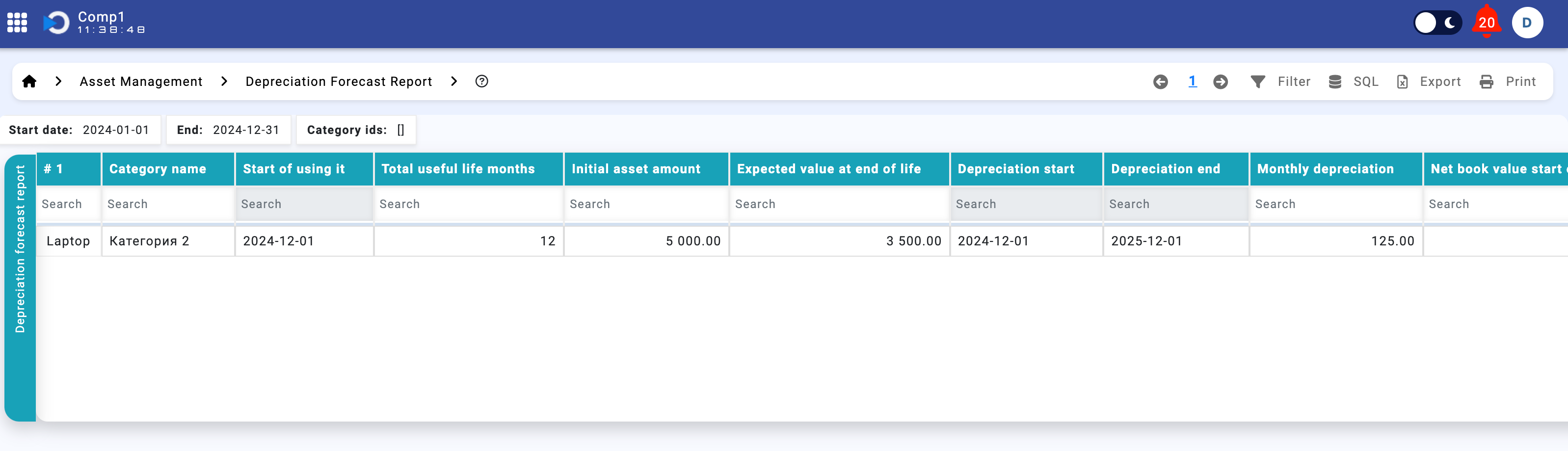

Depreciation Forecast Report

The Depreciation Forecast Report is an essential tool for gaining insights into the financial performance and cost management of long-term assets.

Designed with ease of use and precision, this report provides clear visibility into monthly and cumulative depreciation, helping organizations plan and optimize their budgets effectively.

Depreciation Forecast Report

Key Benefits

- Accurate Budgeting: Quickly see each asset’s monthly and cumulative depreciation within a selected time range.

- Targeted Analysis: Filter by specific asset categories, such as “Vehicles” or “Office Equipment,” to focus on critical costs.

- Comprehensive Overview: Understand each asset’s financial trajectory, including net book values and end-of-life timelines.

Details Captured

- Start of Usage: The date the asset began being used (commissioning date).

- Total Useful Life (Months): The asset’s depreciation schedule in months.

- Initial Asset Amount: The original purchase price.

- Residual Value: The expected value at the end of the asset’s useful life.

- Depreciation Start and End: The official window of depreciation, including the final decommissioning date, if applicable.

- Net Book Value (Start of Range): The asset’s remaining value at the beginning of the reporting period.

- Net Book Value (End of Range): The asset’s remaining value at the end of the reporting period.

- Depreciation in Range: The total depreciation accumulated within the selected date range.

How It Works

- Select Dates and Categories: Users can choose a specific time range and select asset categories for detailed analysis.

- Automated Calculations: The system calculates monthly depreciation using each asset’s acquisition amount, estimated life, and residual value. Partial months are calculated proportionally, ensuring accuracy.

- Generate Forecast: The report provides monthly depreciation figures, cumulative totals, and changes in net book values, offering a clear financial forecast for the selected period.

Why It Matters

- Enhanced Budget Control: Avoid unexpected costs by forecasting when significant asset-related expenses will occur.

- Clear Financial Insights: Compare depreciation, net book values, and overall costs across categories or departments.

- Time-Saving: Eliminate guesswork with an easy-to-read, comprehensive format that lays out monthly and total depreciation figures.

By leveraging this user-friendly report, organizations can plan effectively, manage resources better, and ensure no surprises during budgeting or financial reviews.